Electro-hydraulic servo valves (EHSVs) are critical components in precision control systems, designed to convert electrical signals into precise hydraulic flow or pressure adjustments. These valves play an indispensable role in applications requiring high accuracy, rapid response, and reliable performance—ranging from aerospace flight control to industrial robotics and renewable energy systems. As industries worldwide prioritize automation, efficiency, and precision, the global EHSV market has witnessed steady growth, with evolving technologies and emerging application areas shaping its trajectory. This article provides a comprehensive analysis of the EHSV market, including key drivers, challenges, segmentation, regional dynamics, major players, and future trends.

The EHSV market is a niche but vital segment of the global hydraulic components industry. According to industry reports (e.g., Grand View Research, MarketsandMarkets), the global market size was valued at approximately USD 1.2 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.1% from 2024 to 2030, reaching nearly USD 1.8 billion by the end of the forecast period. This growth is fueled by increasing demand for high-precision control systems across industries and technological advancements in valve design.

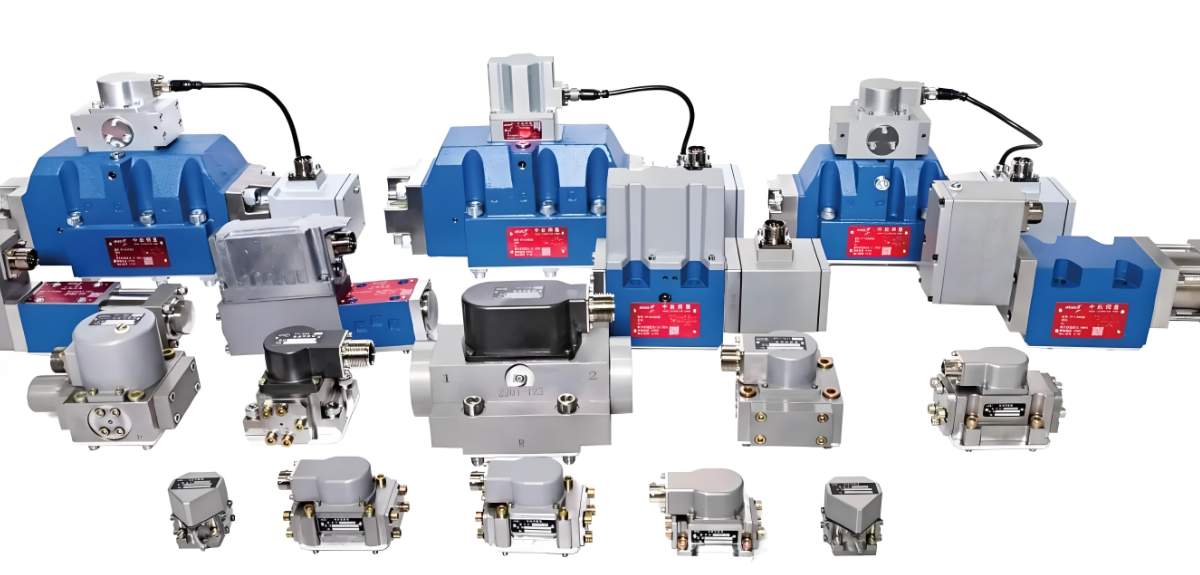

EHSVs are distinguished from conventional hydraulic valves by their ability to deliver micro-level adjustments, making them irreplaceable in scenarios where even minor deviations can lead to operational failures—such as in aircraft landing gear, CNC machine tools, or surgical robots.

Several factors are propelling the expansion of the EHSV market, with industrial modernization and sector-specific demand being the most prominent:

The adoption of Industry 4.0 principles—including smart factories, real-time data analytics, and automated production lines—has heightened the need for precise motion control. EHSVs are integral to CNC machines, industrial robots, and automated assembly systems, where they enable consistent, high-speed adjustments to hydraulic actuators. For example, in automotive manufacturing, EHSVs control robotic arms used in welding and painting, ensuring uniformity and reducing human error. As more manufacturers invest in smart infrastructure, demand for EHSVs is expected to surge.

The A&D sector is the largest end-user of EHSVs, accounting for over 35% of the global market share in 2023. EHSVs are critical to aircraft flight control systems (e.g., ailerons, elevators), missile guidance systems, and military ground vehicles, where they must operate under extreme conditions (high temperature, vibration, pressure) with near-zero failure rates. The global increase in defense spending—particularly in the U.S., China, and India—and the rising production of commercial aircraft (e.g., Boeing 737 MAX, Airbus A320neo) are key drivers for this segment.

The shift toward clean energy has opened new opportunities for EHSVs, especially in wind and solar power. In wind turbines, EHSVs control the pitch of rotor blades, adjusting their angle to optimize energy capture and protect the turbine during high winds. In solar farms, they enable precise positioning of solar panels (tracking systems) to maximize sunlight absorption. With governments worldwide setting ambitious carbon neutrality goals (e.g., EU’s Green Deal), investments in renewable energy infrastructure are expected to drive EHSV demand.

The medical sector increasingly relies on EHSVs for precision equipment such as surgical robots, diagnostic imaging machines, and drug delivery systems. For instance, robotic-assisted surgery (e.g., da Vinci systems) uses EHSVs to control the movement of surgical instruments with sub-millimeter accuracy, reducing invasiveness and improving patient outcomes. As the global aging population drives demand for advanced healthcare solutions, the medical segment is emerging as a fast-growing market for EHSVs.

Despite strong growth prospects, the EHSV market faces several hurdles that could limit its expansion:

EHSVs require complex engineering, precision machining, and strict quality control to meet performance standards. The production of components (e.g., nozzles, flappers, spools) demands specialized materials (e.g., stainless steel, titanium alloys) and advanced manufacturing techniques (e.g., micro-machining), leading to high production costs. Additionally, R&D investments in smart and energy-efficient EHSVs further increase operational expenses, which may deter small and medium-sized enterprises (SMEs) from entering the market.

In certain applications—such as low-load industrial robots or small-scale automation—electro-mechanical servo systems (e.g., servo motors with ball screws) are emerging as alternatives to EHSVs. These systems offer advantages like lower weight, simpler maintenance, and compatibility with digital control systems. While EHSVs remain superior in high-load, high-speed, or harsh-environment applications, competition from electro-mechanical solutions could erode market share in niche segments.

EHSVs depend on metals like steel, aluminum, and specialty alloys for durability and performance. Fluctuations in global commodity prices (driven by supply chain disruptions, geopolitical tensions, or demand-supply imbalances) can increase production costs and reduce profit margins for manufacturers. For example, the 2022-2023 spike in steel prices due to the Russia-Ukraine conflict disrupted EHSV production for several key players.

The EHSV market is highly globalized, with manufacturers relying on specialized suppliers for components (e.g., sensors, electronic controllers) and raw materials. Recent global events—such as the COVID-19 pandemic, semiconductor shortages, and trade restrictions—have exposed vulnerabilities in supply chains, leading to delays in production and delivery. Ensuring supply chain resilience remains a key challenge for market players.

The EHSV market can be segmented based on type, application, and technology, each offering unique insights into market dynamics:

Single-Stage EHSVs: Simple in design, with a single spool or valve element. Ideal for low-flow, low-pressure applications (e.g., small medical devices, laboratory equipment).Two-Stage EHSVs: The dominant type (accounting for ~70% of market share in 2023), featuring a pilot stage (e.g., nozzle-flapper) and a main stage (spool valve). Suitable for high-flow, high-pressure applications (e.g., aerospace, industrial machinery) due to their higher precision and stability.Aerospace & Defense: Largest segment (35%+ market share), driven by aircraft and military vehicle production.

Industrial Automation: Second-largest segment, including CNC machines, robotics, and material handling equipment.

Renewable Energy: Fastest-growing segment, with wind and solar power applications leading demand.

Medical Devices: Emerging segment, fueled by surgical robotics and diagnostic equipment.

Automotive: Niche segment, limited to high-performance vehicles (e.g., racing cars) for suspension and brake control.

Nozzle-Flapper EHSVs: Most common technology, using a nozzle and flapper to control pilot pressure. Offers high responsiveness and reliability.

Jet Pipe EHSVs: Suitable for harsh environments (e.g., high vibration), as they have fewer moving parts than nozzle-flapper designs.

Direct Drive Valves (DDVs): Advanced technology that eliminates the pilot stage, reducing complexity and improving efficiency. Gaining traction in aerospace and high-end industrial applications.

The EHSV market exhibits significant regional variation, driven by industrial development, sectoral demand, and presence of key players:

North America is the largest regional market, accounting for ~38% of global revenue in 2023. The U.S. dominates this region, supported by a strong aerospace & defense industry (home to Boeing, Lockheed Martin) and advanced manufacturing hubs. Major EHSV players like Moog Inc. and Parker Hannifin are also based in the U.S., further boosting market growth.

Europe is the second-largest market, with Germany, the UK, and France as key contributors. Germany’s leadership in industrial automation (e.g., Siemens, Bosch) and automotive manufacturing drives demand for EHSVs in CNC machines and robotics. The UK’s aerospace sector (e.g., Rolls-Royce) and France’s defense industry (e.g., Airbus) also contribute significantly. European players like Bosch Rexroth AG are at the forefront of developing energy-efficient EHSVs, aligning with the region’s sustainability goals.

APAC is the fastest-growing regional market, with a projected CAGR of 7.2% from 2024 to 2030. China, Japan, and South Korea are the primary growth engines:

China: Booming manufacturing sector, investments in renewable energy (wind/solar), and increasing defense spending drive demand.

Japan: Precision engineering capabilities (e.g., Fanuc robotics) and a strong automotive industry support EHSV adoption.

South Korea: Aerospace and semiconductor manufacturing (e.g., Hyundai Aerospace) contribute to market growth.India and Southeast Asian countries (e.g., Vietnam, Thailand) are also emerging as promising markets, fueled by industrialization and infrastructure development.

These regions are smaller but growing steadily, with a CAGR of ~4.5% (MEA) and ~5.0% (Latin America) during the forecast period. Growth is driven by infrastructure projects (e.g., construction, power generation) and increasing investments in defense (e.g., Saudi Arabia’s defense modernization). However, limited industrialization and economic volatility remain constraints.

The EHSV market is highly consolidated, with a few global players dominating the industry, supported by their technological expertise and strong distribution networks. Major players include:

Moog Inc. (U.S.): A leader in high-performance EHSVs for aerospace, defense, and industrial applications. Recent innovations include smart EHSVs with IoT-enabled condition monitoring.

Parker Hannifin Corporation (U.S.): Offers a broad portfolio of EHSVs for industrial automation and mobile machinery. Focuses on sustainability through energy-efficient designs.

Bosch Rexroth AG (Germany): A key player in industrial EHSVs, with a strong presence in Europe. Known for integrating EHSVs with digital control systems for smart factories.

Eaton Corporation plc (Ireland): Specializes in EHSVs for automotive and renewable energy applications. Emphasizes cost-effective solutions for emerging markets.

Danfoss A/S (Denmark): Focuses on EHSVs for mobile and industrial applications, with a focus on energy efficiency and compact design.

To maintain competitiveness, players are adopting strategies such as:

Investing in R&D to develop smart, miniaturized, and eco-friendly EHSVs.Forming partnerships with end-users (e.g., aerospace OEMs) to co-create customized solutions.

Acquiring smaller firms to expand product portfolios (e.g., Moog’s acquisition of hydraulic component manufacturers).The EHSV market is poised for sustained growth, driven by technological innovation and expanding application areas. Key trends shaping the future include:

The integration of sensors and IoT technology into EHSVs enables real-time monitoring of performance parameters (pressure, temperature, flow rate). This facilitates predictive maintenance, reducing downtime and operational costs for end-users. For example, in wind turbines, smart EHSVs can alert operators to potential failures before they occur, minimizing maintenance costs.

As industries demand compact and energy-efficient systems (e.g., medical devices, small robots), manufacturers are developing miniaturized EHSVs with lower power consumption. Advanced materials (e.g., lightweight alloys) and optimized designs are also reducing the environmental footprint of EHSVs, aligning with global sustainability goals.

New application areas are emerging, including autonomous vehicles (EHSVs for brake and suspension control), underwater robotics (for offshore oil & gas), and additive manufacturing (3D printing of hydraulic components). These areas offer untapped growth potential for EHSV manufacturers.

In response to recent disruptions, players are diversifying their supplier base, investing in local manufacturing, and adopting digital tools (e.g., AI-driven supply chain management) to enhance resilience.

The global electro-hydraulic servo valve market is a dynamic and growing industry, driven by the need for precision control across aerospace, industrial, renewable energy, and medical sectors. While challenges like high costs and competition from electro-mechanical systems exist, the market’s long-term prospects remain strong—fueled by technological innovations (smart, energy-efficient EHSVs) and the expansion of emerging economies. For market players, success will depend on investing in R&D, building resilient supply chains, and adapting to evolving end-user needs. As industries continue to prioritize accuracy, reliability, and sustainability, EHSVs will remain a critical component of modern control systems, ensuring the market’s growth for years to come.